Recreational district receives enough signatures to go on the ballot

SHELLEY: Proponents for the proposed recreational district received word last week from the Bingham County Elections office that they had gathered enough signatures to ask voters if they would approve of the district’s creation on the November ballot.

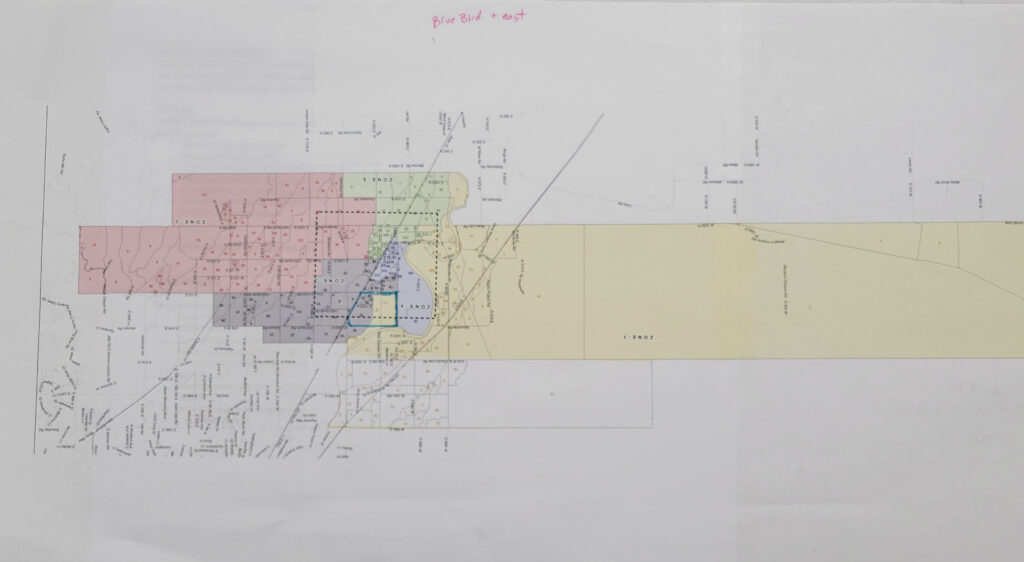

Although it has been several years in the planning, the proposed recreational district, which reflects the boundary of the Shelley school district in northern Bingham County, is one step closer to becoming a reality.

“We wanted the district to reflect the Shelley school district’s boundaries,” said Rory Christensen, the lead person of a proposed district. “We excluded the Bonneville County portion of the school district because we didn’t want two sets of County commissioners to deal with.”

According to state statute 31-4304 (a), a recreational district election requires a petition to be signed by no less than twenty percent (20%) of the qualified electors residing within the proposed district’s boundaries. “We received that plus quite a few more.” Said Christensen.

For the district to become a reality, it will require a 51% favorable vote in the November election. According to state statute 31-4304 (e), “If more than one-half (1/2) of the votes cast at such election are in favor of forming such district, the county commissioners shall enter an order so finding, declaring such district duly organized under the name designated in such petition….”

Last Wednesday, a group representing various sporting clubs and recreational enthusiasts, including people interested in acquiring the North Bingham County Historical Park, gathered at City Hall to discuss plans to sell the recreational district to the public. Christensen also invited Mayor Pascoe and Councilman Adam French to attend the meeting.

The questions at the meeting quickly turned to the cost of a recreational district as Christensen said, “she needed to know by Friday morning what tax levy the proposed district would be seeking in the upcoming election.”

According to state statute 31-4318 (1), the [district] board is empowered to levy a tax for the uses and purposes of the district in an amount not exceeding six-hundredths percent (.06%) of the market value for assessment purposes on all of the taxable property within the district. This tax is used for operational expenses incurred by the district.

Using the current bonding capacity of the school district, which is $530,562,520, Christensen wrote various tax rates ranging from 0.039 to 0.06% on the board. These rates produced a taxable revenue for the proposed district between $206,919 to $318,337.

According to the Idaho State Tax Commission, a $300,000 home would have a maximum homeowner’s exemption of $125,000 or taxable assessed value at $175,000. If the proposed recreational district tax levy were .0039%, it would produce a taxable income of

$68.25 per year, or $5.69 per month from a $300,000 assessed dwelling. If the tax levy were at the maximum rate of 0.06%, it would produce a taxable income of $105 per year or $8.75 per month for the same home.

Christensen said, “I used the .0039% as a baseline because it is what Jerome County’s Recreational District uses. However, Karrie Winder stated, “They are a lot bigger than us, though. They have been around since 1976.” Christensen agreed and said, “they have been around for a very long time and had a budget over $1 million.”

Councilmember Adam French chimed in, “If you go and tell someone that will only cost them $60 per year based on a $200,000 assessed house, they will work it out in their head it will cost them $200 per year more in taxes based on their higher home value. Are you going to be able to sell them on that?”

The discussion quickly turned to what you get for that kind of money. Stephanie Balmforth said, “After cost, the second question they are going to ask you is what is your plan?

The committee concluded that they needed to have a platform. Mike Balmforth said, “If I go out and sell this [district], I have to have something to sell. I can’t say the sky is the limit, and give me whatever you want.”

Eventually, the group decided to leave it up to the public at Spud Day to decide what they wanted in a recreational district. However, the group decided to use the maximum 0.06% tax rate to maintain the recreational district and its proposed programs.

According to Christensen, the recreational district will be governed by a seven-member board. Committee members will suggest board members but are ultimately voted on by the County Commissioners. “This board will use grants and donations to build pickleball courts, sports complexes, and parks.”

Pascoe stated at the end of the meeting, “I want everyone to know the city Shelley will have no power over this district. This district will have its own board and will be a different entity from the city.”

As for North Bingham Historical County Park, the city of Shelley plans to acquire it from the county and provide it with water rights. Pascoe said, “Once the recreational district passes, it will take ownership of the park.”

The formal name of the district is “The North End Recreation District.”