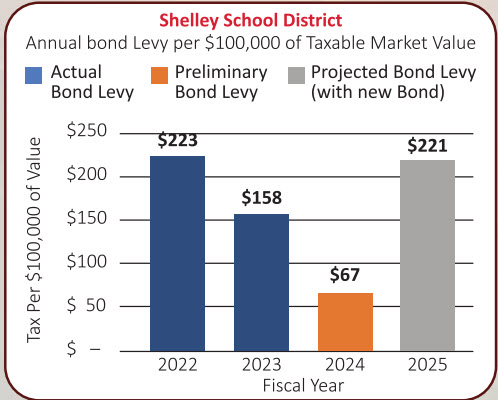

High school bond, if passed, will not increase the patron’s current tax burden!

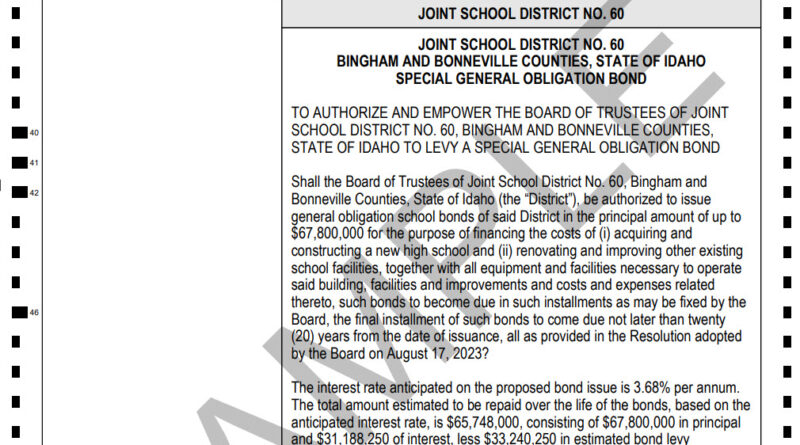

SHELLEY: Shelley School District Superintendent Chad William explained to a small group of people who attended last night’s high school bond meeting that although the bond will increase your property tax, it will not increase your current property tax burden.

At last night’s sparsely attended school bond meeting, Shelley School District Superintendent Chad Williams went over the high school bond flyer in detail when it became apparent to several patrons that if the bond passes, it will not increase the school district tax levy over its 2022 level. It will be slightly less.

Dalan Andrews, a school district patron and former school board member, exclaimed, “I feel a lot better about this bond now than I did coming in here tonight.”

According to Williams, the school currently has a tax levy of 0.00223 as of 2022. That levy rate dropped to 0.00158 in 2023 because of the increase in market value placed on the properties district-wide by the Bingham and Bonneville County Assessor’s Offices.

In 2024, the levy will drop to 0.00067 as the Shelley School District recently received from the State $915,577, which it applied toward its outstanding bond levy. This money comes from House Bill 292.

The State passed House Bill 292 into legislation earlier this year. It provides immediate, long-term property tax relief to all property taxpayers in Idaho.

“The bill’s first year provides up to $355 million in property tax relief. In the second and third years, approximately $110 million will be used to reduce property taxes for owner-occupied taxpayers, approximately $100 million will be used to reduce property taxes for all property taxpayers, and another approximately $100 million will be distributed to school districts on average daily attendance basis,” according to the bill’s Statement of Purpose.

The bill further states, “School districts are required to use funds in the order of priority as follows: (1) payment of school bonds (2) payment of school levies (3) save for future school facility constructions and needs (4) used for new bonds.

If the high school bond passes, it will increase the bond levy by 0.00154 or from 0.00067 to a levy rate of 0.00221 in 2025. This tax levy rate is slightly less than the tax levy of 0.00223, which property taxpayers just paid for their 2022 assessment. Businesses and homeowners pay the same levy rate in the school district.

“I would hold another public meeting and inform the people about this. I’d have the school board members sit there on the stage and present to them what you told us tonight,” Andrew said.